Hydrogen’s Role in Economic Diversification and Market Growth in the Gulf

By Mark Achkar; Edited by Andrew Ma

Introduction

For decades, the economic prosperity of the Gulf states has been inextricably linked to oil and gas exports. These resources have fueled rapid development, infrastructure expansion, and geopolitical influence. However, as global demand for fossil fuels slows in response to climate change initiatives, net-zero commitments, and carbon pricing mechanisms, the Gulf states must adapt or risk economic stagnation.

Hydrogen offers a new economic frontier that aligns with decarbonization goals and the Gulf’s expertise in energy production. By investing in hydrogen as a long-term export commodity, Oman, Saudi Arabia, and the UAE aim to secure their roles in the global energy market, even as traditional oil demand declines.

This transition is not just about energy exports. Hydrogen could revolutionize domestic industries, from green steel and ammonia production to clean fuels and hydrogen-powered transport. It also carries geopolitical significance as the Gulf nations forge new trade partnerships with Europe, Asia, and beyond. However, major challenges remain, including infrastructure bottlenecks, transport limitations, and cost competitiveness.

This article explores how hydrogen is shaping the next phase of economic diversification in the Gulf, addressing its potential, challenges, and strategic impact on global markets.

Economic Implications: Diversification Beyond Oil and Gas

Developing a hydrogen economy carries significant economic implications for Middle Eastern countries, many of which have been historically dependent on oil and gas revenues. A major driver behind the hydrogen push in Oman, Saudi Arabia, and the UAE is the desire to diversify national economies and create new industrial sectors that can thrive in a decarbonizing world. Saudi Arabia’s Vision 2030 explicitly frames hydrogen as a means to "diversify exports" and build new value chains on top of existing capabilities in petrochemicals and fuel production. By exporting hydrogen (and its derivatives, like ammonia), Saudi Arabia can maintain its role as an energy exporter even if global oil demand wanes due to climate policies. Similarly, Omani officials highlight hydrogen as an opportunity to "create economic value, increase industrial competitiveness and attract investments,” thus strengthening the economy beyond oil. Oman’s Vision 2040 and hydrogen strategy envisage sizable foreign direct investment and infrastructure spending, which could boost GDP and job creation in engineering, construction, and operations. Indeed, realizing Oman’s hydrogen production goals could transform it into a major supplier of energy in the form of green fuels, rather than fossil fuels, by mid-century–an economic shift that reduces vulnerability to oil market volatility.

The hydrogen sector also promises to stimulate new industries and skills in the region. For example, the manufacturing of equipment (such as electrolyzers, fuel cells, hydrogen storage tanks) could take root locally if demand is sufficient. There are early signs of this: Saudi Arabia has explored localizing fuel cell vehicle assembly (through agreements with companies like Hyzon Motors and Gaussin), and the UAE’s Masdar is considering producing electrolyzers domestically in partnership with international firms. Moreover, hydrogen enables the greening of existing heavy industries – providing a path to keep industries like steel, aluminum, cement, and chemicals competitive as global markets favor low-carbon products. The economic value is twofold: securing the future of core industrial exports (e.g. “green steel” or low-carbon aluminum) and potentially exporting surplus hydrogen. Governments are also structuring hydrogen projects to maximize local benefit; for instance, Oman’s Hydrom requires developers to invest in common infrastructure (pipelines, desalination, storage) that can be shared, and integrated with local supply chains where possible. This approach could create domestic hubs of hydrogen production with surrounding industries (sometimes termed “hydrogen oases” or clusters) that together add value to the economy. A practical example is the NEOM project in Saudi Arabia: not only is it an export venture, but it’s part of a broader vision to diversify the kingdom’s economy. NEOM—whose name combines the Greek word “neo” meaning “new” and the Arabic word “mustaqbal” meaning “future”—is a planned smart city aimed at becoming a hub for innovation, sustainability, and advanced technology. One of its key components is Oxagon, a planned industrial city that will host advanced industries utilizing clean energy, thereby attracting high-tech investment and skilled jobs to the kingdom.

That said, the economic benefits are not guaranteed and depend on the global market viability of hydrogen. These projects involve multibillion-dollar investments with long payback periods. The Middle East’s bet is that by achieving economies of scale and using cost-advantaged resources (cheap solar land, existing energy infrastructure), they can produce hydrogen at low cost to beat competitors. Current estimates suggest the Gulf could eventually supply green hydrogen at around $1.50–$2 per kilogram in favorable conditions, which would be among the cheapest globally. In order to justify investments in the present, many projects have secured offtake agreements or subsidies. For example, NEOM’s plant has a 30-year offtake contract with Air Products, and countries like Germany and Japan are setting up subsidy schemes for imported green hydrogen by 2030. If these markets materialize, hydrogen exports could become a steady revenue stream for Oman, Saudi Arabia, and the UAE, partly replacing oil and gas income. In summary, the hydrogen push is a cornerstone of economic diversification plans. It aims to future-proof the Gulf economies by building a new “post-oil” export industry that leverages existing strengths (such as energy expertise and capital) while opening avenues for sustainable growth.

Geopolitical Consequences: Cooperation, Competition, and Regional Stability

The emergence of a hydrogen-based economy in the Middle East carries several geopolitical implications, both within the region and in its relations with the rest of the world. Energy geopolitics has long been shaped by the Middle East’s oil and gas exports; as hydrogen emerges, it could reshape alliances and competition in similar ways. One notable trend is new patterns of international cooperation: Middle Eastern countries are forging partnerships with hydrogen-importing nations, which could deepen strategic ties. For instance, the UAE and Germany have signed agreements for hydrogen shipments and technology exchange (blue ammonia demonstration cargos were sent from the UAE to Germany in 2022). Similarly, Saudi Arabia’s pilot exports of blue ammonia to Japan and its collaborations with South Korea (such as the Hyundai Oilbank deal) cement relationships with Asian economies looking for clean fuels. Oman has engaged in cooperation with European partners–notably, a joint study with the Port of Amsterdam on shipping Omani green hydrogen to Europe. These partnerships indicate that trade routes for hydrogen (whether via pipelines or shipping lanes) could become new links connecting the Middle East with Europe and East Asia, potentially increasing interdependence. The planned India-Middle East-Europe economic corridor (with a proposed hydrogen pipeline) is a concrete example of geopolitics and infrastructure aligning to create new transregional ties. If successfully built, such corridors could bypass traditional chokepoints (like the Suez Canal) and alter trade dynamics, possibly enhancing energy security for importers while ensuring markets for Middle Eastern hydrogen exporters.

Within the Middle East, the hydrogen race also introduces a competitive dynamic among regional powers, albeit one that could remain relatively friendly. Saudi Arabia and the UAE, for instance, both aspire to lead in hydrogen and have made overlapping market claims (Saudi aiming to be top exporter, UAE aiming for 25% market share). This economic rivalry, much like their competition in diversifying economies and attracting foreign investment, could spur faster innovation and project development as each seeks an edge—similar to the space race between the United States and the Soviet Union. Both countries launched high-profile projects and made bold announcements around the timing of COP climate conferences and other international events, which suggests a race for prestige and market positioning. This is further exemplified by the fact that the UAE is hosting COP28, the 28th United Nations Climate Change Conference, in November 2025. However, there is also a sense of collaboration and shared interest: Gulf states regularly discuss energy strategies through platforms like the GCC (Gulf Cooperation Council), and there is potential for regional hydrogen cooperation. For instance, this cooperation could involve standardizing hydrogen regulations across the region, or even linking infrastructure networks in the future to create a more integrated Gulf hydrogen economy. Oman’s pipeline plans might eventually connect to UAE or Saudi networks if a regional grid materializes, and companies like ADNOC (Abu Dhabi National Oil Company) and Mitsubishi are working together on blue hydrogen value chains, which shows cross-border industry cooperation. In the broader Middle East, hydrogen could also offer opportunities for countries like Jordan and Egypt (both of which have abundant land and solar resources) to partner with Gulf states on the renewable energy supply chain. Such collaboration could help ease economic disparities and foster regional stability through joint development projects.

Another geopolitical consideration is how a successful hydrogen export industry could preserve the strategic importance of the Middle East in global energy supply. If European and Asian countries come to rely on Gulf hydrogen as a significant part of their energy mix by the 2030s or 2040s, the Middle East would maintain leverage and influence similar to the oil era, but in a decarbonized context. This could grant Middle Eastern producers continued political capital on the world stage, positioning them as indispensable partners in global efforts to achieve climate targets. It might also mitigate the risk of economic instability if oil revenues declined without replacement. Therefore, maintaining strong economies via hydrogen exports can contribute to domestic stability, which in turn has regional security benefits. The transition to hydrogen is not without its geopolitical risks, however. As with oil and gas, resource and transit security will be crucial—export facilities, pipelines, and ships could become points of tension or targets in conflicts if any arise. Additionally, there could be new disputes over technology access (e.g. disagreements over intellectual property for advanced electrolyzers or fuel cells) or standards (such as how to certify hydrogen as “green” or low-carbon—a debate already happening between Europe and exporting countries). Nevertheless, analysts are optimistic that hydrogen, a clean energy carrier, could become a field of cooperation that transcends the old resource conflicts and unites shared global climate goals. There is even speculation that a robust hydrogen trade could help ease geopolitical tensions by creating new mutual dependencies. For example, Europe’s need for Middle Eastern hydrogen might balance Europe’s pressure on oil states to decarbonize, leading to a collaborative relationship focused on climate technology rather than just hydrocarbons.

In summary, the geopolitical consequences of the Middle East’s hydrogen push include new alliances with importing regions, an intra-regional race for leadership, and the potential extension of the Middle East’s energy influence into the clean energy era. The success of this transition could contribute to regional stability by providing economic continuity and encouraging collaboration. However, surveillance will be necessary to manage any emergent rivalries or security concerns associated with the new hydrogen infrastructure and supply chains.

Green vs. Blue Hydrogen: Environmental Sustainability Considerations

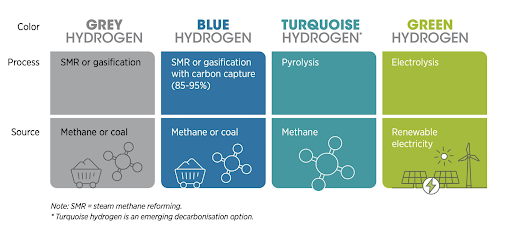

A critical aspect of the hydrogen economy is its environmental sustainability. Not all hydrogen is created equal. Green hydrogen is virtually carbon-free in usage and production (apart from the indirect emissions of building renewable infrastructure), whereas blue hydrogen and gray hydrogen involve fossil fuels and thus have associated emissions. Middle Eastern strategies encompass both green and blue hydrogen, raising questions about the true environmental impact and how these approaches compare.

Green hydrogen, produced by splitting water with renewable electricity, is lauded as a zero-emissions fuel—when used in a fuel cell or burned, it emits only water vapor. For Gulf states like Oman, Saudi Arabia, and the UAE, green hydrogen aligns with their long-term net-zero commitments (Oman and UAE aim for net zero by 2050, Saudi by 2060) and leverages their rich solar irradiance and wind potential. A major environmental advantage of green hydrogen is that it does not involve fossil fuel extraction, thereby avoiding greenhouse gas emissions from both the fuel and the process. However, green hydrogen production in the Middle East must reckon with significant water usage. Electrolysis requires pure water, and producing one ton of hydrogen needs about 9–10 tons of water. In dry climate countries, this water will likely come from desalination. Desalination is energy-intensive and can have its own environmental footprint (brine discharge, marine impacts), though if powered by excess renewable energy, it can be made sustainable. Oman, for example, is incorporating plans for desalination plants alongside its hydrogen projects, and the UAE’s strategy discusses using its coastline and existing desal infrastructure to supply electrolysis. Another consideration for green hydrogen is land use: large solar and wind farms are needed. Fortunately, Oman and Saudi Arabia have expansive desert areas with high sun and, in Oman’s case, good wind in coastal areas, meaning land availability is less of a constraint than in many other countries. The environmental impact of green hydrogen is overwhelmingly positive when it displaces fossil fuels, but attention is needed to manage local impacts (like ensuring desalinated water supply is efficient and ecological).

This chart illustrates the four main types of hydrogen (grey, blue, turquoise, and green) based on their production processes and energy sources. While grey and blue hydrogen are derived from fossil fuels like methane or coal (with blue incorporating carbon capture), green hydrogen is produced using renewable electricity through electrolysis. Turquoise hydrogen, a newer option, uses methane pyrolysis and is considered an emerging decarbonization method.

Blue hydrogen is often described as a “bridge” solution—it leverages fossil fuels (natural gas or even oil/coal) but with carbon capture and storage (CCS) to reduce emissions. The Middle East’s blue hydrogen plans typically involve steam methane reforming (SMR) of natural gas with CCS to trap the CO₂ byproduct. In theory, a properly designed blue hydrogen facility can capture 90% or more of the CO₂, significantly lowering the carbon footprint compared to traditional hydrogen (gray hydrogen), which releases all CO₂. For example, ADNOC’s planned blue ammonia plant will sequester the CO₂ from gas feedstock to deliver a low-carbon product. However, there are valid environmental concerns about blue hydrogen. One challenge is that CCS is not 100% effective, and even an 85–90% capture rate means some emissions still occur. Additionally, upstream methane leakage is a serious issue: natural gas consists largely of methane, a potent greenhouse gas, and any leaks during drilling, processing, or transport diminish the climate benefit of blue hydrogen. Studies have warned that if methane leakage rates are high (a few percent of throughput), the lifecycle emissions of blue hydrogen can be worse than simply burning natural gas directly. In fact, research by Cornell and Stanford in 2021 famously estimated that the carbon footprint of blue hydrogen might be 20% greater than burning natural gas for energy once methane leaks and the energy for CCS are accounted for. Industry groups have contested some of these findings, arguing that with modern infrastructure methane leakage can be minimized (well below 1.5%) and that using renewable energy to power the SMR and CCS processes can cut emissions further. The Middle East’s advantage is that its oil & gas operations are relatively centralized and modern, which could help keep fugitive emissions low compared to dispersed production elsewhere. Saudi Aramco and ADNOC, for instance, report having some of the lowest methane intensities in the industry and participate in initiatives aimed at achieving near-zero methane leakage.

Nonetheless, environmentalists stress that blue hydrogen is at best a low-carbon solution, not a zero-carbon one. It can reduce emissions in the short term and make use of existing assets (like natural gas fields and pipelines), but it does not eliminate the fossil fuel dependency. Also, storing captured CO₂ long-term (often in geological formations) must be done carefully to avoid future leakage or induced seismicity. In the Gulf region, some of the captured CO₂ might be used for Enhanced Oil Recovery (EOR)—which ironically leads to more oil production, somewhat counteracting the climate benefit. The sustainability debate, therefore, leans towards favoring green hydrogen in the long run. Oman and the UAE have clearly indicated green hydrogen as the endgame (as seen by their 2050 all-green targets), with blue as a stepping stone. Saudi Arabia is heavily pushing blue in the 2020s to gain market share quickly, but is also investing in green via NEOM and other renewable projects.

From an environmental policy standpoint, the rise of hydrogen in these countries is tied to their climate action plans. The UAE hosting COP28 and announcing the hydrogen strategy is a signal of integrating climate commitments with economic plans. Oman's 2050 net-zero pledge explicitly mentions green hydrogen as a tool for domestic decarbonization (not just export). For example, if Oman produces 8.5 million tons of green hydrogen by 2050, a portion could be used to decarbonize local power, heavy transport, and industry, which would drastically cut Omani emissions while the rest is exported. The avoidance of local pollution is another environmental plus: hydrogen production via electrolysis has minimal local air pollutants (just oxygen release), whereas continuing to burn oil or gas can cause sulfur dioxide (SOx) and nitrogen oxides (NOx) and particulate pollution. In oil and gas-rich Gulf states, shifting some domestic energy use to clean hydrogen (or ammonia in power plants) could improve air quality and public health.

In summary, green hydrogen is the ultimate goal for sustainability, and the Middle East is endowed with the resources to produce it at scale. Blue hydrogen offers a lower-emission alternative to gray hydrogen in the present, but its climate credentials depend on effective carbon capture and ultra-low methane leakage—which are challenges that must be rigorously managed. The environmental success of the hydrogen economy in the Middle East will thus hinge on the timely scaling of green hydrogen and the careful implementation of any blue hydrogen projects to ensure they genuinely deliver on emissions reductions.

Infrastructure, Transport, and Market Viability Challenges

While the Middle East’s hydrogen ambitions are grand, realizing them requires overcoming significant infrastructure and market challenges. Hydrogen is a very different commodity than oil or liquefied natural gas (LNG), and developing a full supply chain—from production to delivery—is a complex undertaking. Here, we outline the key challenges related to infrastructure, transport, and the international market viability of Middle Eastern hydrogen.

1. Transport and Export Logistics: One of the biggest questions is how to ship hydrogen from the Middle East to consumers overseas in a cost-effective manner. Hydrogen has a low energy density per volume, especially as a gas, making direct transport difficult. There are several approaches under consideration:

Ammonia as a Carrier: The leading solution for long-distance export is to convert hydrogen to ammonia (NH₃) by combining it with nitrogen. Ammonia, a common chemical, can be liquefied and shipped using relatively standard chemical tankers. All three focus countries are planning to export ammonia (green or blue) rather than gaseous hydrogen. For example, Oman's projects explicitly plan ammonia production on-site, Saudi Arabia's NEOM output will be entirely in ammonia form, and the UAE's ADNOC is building blue ammonia facilities. Shipping ammonia is more efficient than liquid hydrogen—ammonia liquefies at -33°C, whereas hydrogen needs -253°C, a much harder cryogenic requirement. The challenge with ammonia is that many end-users (e.g. power plants, fuel cell vehicles) need pure hydrogen, so the ammonia must be “cracked” back to hydrogen at the destination or used directly in specialized applications (like ammonia power turbines or as fertilizer). Cracking technology adds cost and energy loss, but importing countries like Japan and Germany are investing in this area. Middle Eastern exporters will need to coordinate with buyers on building import terminals, ammonia crackers or ammonia-capable infrastructure. This is underway—Japan has co-funded ammonia-cofiring trials in power plants, and Germany is exploring using ammonia in former coal plants.

Liquified or Compressed Hydrogen: Directly shipping liquefied hydrogen is another route (as pioneered by a Japanese trial from Australia in 2022). However, the extreme cold needed and boil-off gas issues make this very expensive and energy-intensive. It’s likely not economically viable for the Middle East-to-Europe/Asia routes at scale in the near term. Compressed hydrogen gas in pipelines or tube trailers is feasible for shorter distances or local distribution but not for intercontinental trade due to low volume per shipment.

Liquid Organic Hydrogen Carriers (LOHC) and Methanol: Other chemical carriers are being researched, like binding hydrogen to liquid organic compounds that can be shipped in oil tankers and then released at the destination. Methanol (CH₃OH) is another derivative that can be made from hydrogen and CO₂; it’s easier to handle than H₂ and can be used as fuel or chemical feedstock directly. Some Middle East projects (like Oman's GEO) mention producing methanol and synthetic fuels in addition to ammonia, which could diversify export offerings. Each carrier has trade-offs in energy conversion losses and infrastructure requirements.

No matter which pathway is chosen, the Middle East will have to invest heavily in export infrastructure: new port terminals, cryogenic storage, tanker ships, and possibly pipelines will be necessary for transporting hydrogen internationally. The idea of a transnational hydrogen pipeline is being explored: for example, running a pipeline from North Africa or the Eastern Mediterranean into Europe. Oman's internal 1,000 km pipeline plan could one day connect to a broader network, but geopolitical barriers (crossing multiple countries) and costs are significant. Still, Europe’s Hydrogen Backbone initiative imagines pipelines bringing hydrogen from its periphery (including North Africa) by 2040.

The Gulf’s distance is larger, so pipelines might only be realistic if connecting to the Red Sea and then through the Suez to the Mediterranean. In the meantime, shipping by sea will be the main mode, requiring a fleet of ammonia tankers. Fortunately, the Gulf nations have experience in seaborne energy trade and can repurpose some LNG expertise (ammonia shipping is similar to LNG shipping). The first trial shipments—such as UAE’s blue ammonia to Asia and Saudi’s to Japan and China—have tested the logistics, but scaling to millions of tons will test port capacities and supply chain coordination.

2. Domestic Infrastructure: Another challenge is building out domestic infrastructure for hydrogen, including the following necessities.

Production Facilities: Gigawatt-scale electrolyzer farms or SMR with CCS units—these are essentially new industrial plants that must be constructed and operated reliably. The supply chain for electrolyzers is global and currently constrained (mostly produced in Europe, China, US). Gulf countries may face lead times in getting enough electrolyzer capacity delivered for their 2030 goals. Scaling from pilot projects to full industrial scale (hundreds of thousands of tons) in a few years is ambitious, though projects like NEOM are serving as pathfinders.

Pipelines and Storage: Within a production cluster, hydrogen may need to be piped from the electrolyzer or plant to the port or industrial users. Hydrogen can embrittle steel pipelines, so either new materials or retrofits are needed. Oman’s approach to developing common pipeline networks via Hydrom is forward-looking. Hydrom, Oman’s state-owned hydrogen platform, is tasked with overseeing the planning and coordination of the country’s green hydrogen sector. By centralizing infrastructure planning, Oman aims to streamline project development, reduce duplication, and attract international investment—positioning itself as a key regional player in hydrogen exports. Salt caverns or tanks for hydrogen storage (or ammonia storage tanks) will also be required to buffer production. The region’s geology could allow salt cavern storage (Saudi Arabia and Oman have salt dome areas), which would help balance intermittent renewable production feeding electrolyzers.

Power and Water Supply: Green hydrogen needs large renewable power plants. Integrating these into the grid or operating them as dedicated off-grid complexes is a logistical task. Many projects will be in remote areas (desert or coastal plains), so transmission lines or on-site usage of power must be planned. Additionally, water desalination units need to be built to feed electrolyzers with demineralized water. Ensuring a sustainable water supply without harming marine ecosystems will be important (e.g., managing brine).

Safety and Regulations: Hydrogen is flammable and has different properties from natural gas (it is odorless, leaks more easily due to small molecule size, and has a wide combustion range). Gulf countries will need to update safety standards, train personnel, and educate the public if hydrogen is to be used domestically (like in vehicle fueling or in the gas grid). So far, hydrogen vehicles and fueling stations are at pilot stages in the region; wider adoption will require codes and standards to be in place.

3. Market Viability and Economics: Ultimately, the success of the Middle East’s hydrogen initiatives hinges on economics – can they produce and deliver hydrogen at a price that international markets will pay, and will there be sustained demand?

Currently, green hydrogen is more expensive than fossil fuels; estimates range from $3–6 per kg for green hydrogen in 2023 (depending on location and scale) versus $1–2 per kg for hydrogen made from natural gas without CCS (gray hydrogen). Blue hydrogen costs somewhere in between, roughly $2 per kg if gas is cheap and capture is efficient. For example, in late 2023, the cost of producing hydrogen via natural gas + CCS in Qatar was estimated at about $1.84/kg, whereas via electrolysis in Saudi Arabia was about $3.22/kg. This cost gap means that, without either a carbon tax on emissions or a market premium for green hydrogen, buyers are likely to opt for the cheape (and more polluting) conventional hydrogen. The Middle East’s traditional advantage is low-cost energy: cheap natural gas in some countries and extremely low-cost solar power (record-breaking solar tariffs under 2 cents/kWh in UAE and Saudi Arabia). If they can channel these energy avenues into hydrogen, they can drive costs down. Analysts project that Saudi Arabia and Oman could produce green hydrogen below $2/kg by 2030 given high-capacity-factor renewables (thanks to strong sun and wind) and economies of scale.

Reaching such cost levels is crucial for market viability, because the imported cost to Europe or Asia will include transport and conversion costs that add $1–2/kg. Europe’s willingness to pay will depend on its carbon pricing and regulations—the EU is formulating standards for what counts as green hydrogen and may offer contracts for differences to cover the cost gap for importers. Japan and South Korea are also creating hydrogen import frameworks as part of their net-zero plans. Middle East producers will likely rely on these policy-driven markets in the 2030s. A challenge here is ensuring their hydrogen meets the stringent definitions (for instance, the EU requires additional renewable capacity and specific carbon accounting). To meet this challenge, Gulf countries are actively setting standards to ensure their hydrogen and ammonia are accepted as “clean” in destination markets.

Another market uncertainty is demand volume. While there is much hype, how fast will consuming countries actually scale up hydrogen use? If Europe’s economy faces recession or if alternative solutions (like direct electrification or batteries) outcompete hydrogen in certain sectors, the anticipated demand could be lower than expected. Middle East projects with high fixed costs could then face underutilization. To hedge against this, these countries are also exploring domestic demand: for example, using hydrogen in refining processes, in petrochemical production (e.g., making ammonia or methanol locally), in power generation (co-firing hydrogen or ammonia in thermal power plants), and in heavy transport. The UAE and Saudi Arabia both have pilot plans to use hydrogen or ammonia for electricity generation in existing plants to cut CO₂ emissions. Such domestic use can help anchor initial projects and demonstrate viability.

4. Financing and Investment Risks: Building the hydrogen economy will require hundreds of billions of dollars over the next decades in the Middle East. While many projects have government backing (through state-owned companies and wealth funds), private and international investment is also sought after.

A positive development was the ability of NEOM’s project to raise $6.1 billion in non-recourse debt from banks—showing that financiers are willing to bet on large hydrogen ventures. Oman, too, is attracting interest from European investors for its projects. However, investors will carefully evaluate risks like technology performance, construction delays, and the uncertainty of future hydrogen prices. If oil prices remain high in the short term, Gulf governments have ample funds to spend on hydrogen as a strategic play. But if an oil downturn occurs, some hydrogen investments could be delayed, since they are still not generating revenue at scale. Therefore, securing long-term offtake contracts (as many projects are doing) and possibly multilateral development bank support can de-risk these massive projects. The incorporation of hydrogen into national development plans means that, politically, these projects are likely to be sustained, but the pace of rollout might fluctuate with cycles.

In conclusion, the Middle East faces many challenges to build a hydrogen economy: it must develop new infrastructure, master hydrogen transport logistics, and ensure that there are buyers ready to pay for clean hydrogen at a price that justifies the investment. The region’s experience with large energy projects and its cost advantages give it a solid foundation. Early milestones—such as demonstration shipments, financing of mega-plants, and the creation of regulatory roadmaps—are encouraging signs that Oman, Saudi Arabia, and the UAE are proactively tackling these challenges. Over the next decade, progress in areas like pipeline technology, international hydrogen standards, and cost reductions will determine just how viable the grand vision of Middle East hydrogen exports really is. If successful, these countries could usher in a new era in which pipelines and tankers carry green fuels instead of oil, fundamentally transforming global energy trade.

Conclusion

Hydrogen represents more than just a cleaner fuel source—it is a strategic investment in the Gulf’s future economic resilience. With the demand for fossil fuels expected to decline in the coming decades, Oman, Saudi Arabia, and the UAE are proactively shifting toward low-carbon energy exports, ensuring their economies remain competitive in a low-carbon world.

By integrating hydrogen into their industrial ecosystems, these countries have an opportunity to create high-value industries such as green steel, ammonia production, and synthetic fuels, reducing dependence on oil while maintaining their status as energy powerhouses. This transformation is already underway, with billions being poured into hydrogen mega-projects, industrial hubs, and international trade partnerships.

However, realizing the full economic potential of hydrogen requires overcoming major challenges:

Can the Gulf states develop the necessary infrastructure to transport and store hydrogen efficiently?

Will global markets sustain high demand for Gulf-produced hydrogen?

How can the region balance domestic energy needs with export ambitions?

The answers to these questions will define whether hydrogen becomes a game-changer for Gulf economies or merely an ambitious experiment. What is certain, however, is that the Gulf is determined to be at the center of this energy transition, ensuring that even in a net-zero world, it remains a sought-after energy supplier.